In today’s interconnected world, sending money across borders has become faster, cheaper, and more convenient. Nigeria, with its vast diaspora community, receives significant remittances annually – over $25 billion in 2020 alone. For Nigerians living abroad or those with financial ties to the country, choosing the right mobile platform can significantly impact the efficiency and cost of transactions. Hence the need for us to be abreast with the information on top-notch apps to send money to Nigerian accounts from overseas.

With the proliferation of fintech and mobile technology, numerous apps have emerged,

offering secure, efficient, and cost-effective ways to transfer funds. Whether you are supporting your family, paying for services, or investing in business ventures, selecting the best app is very imperative. Having buttressed these points, let’s jump to my list of recommendations:

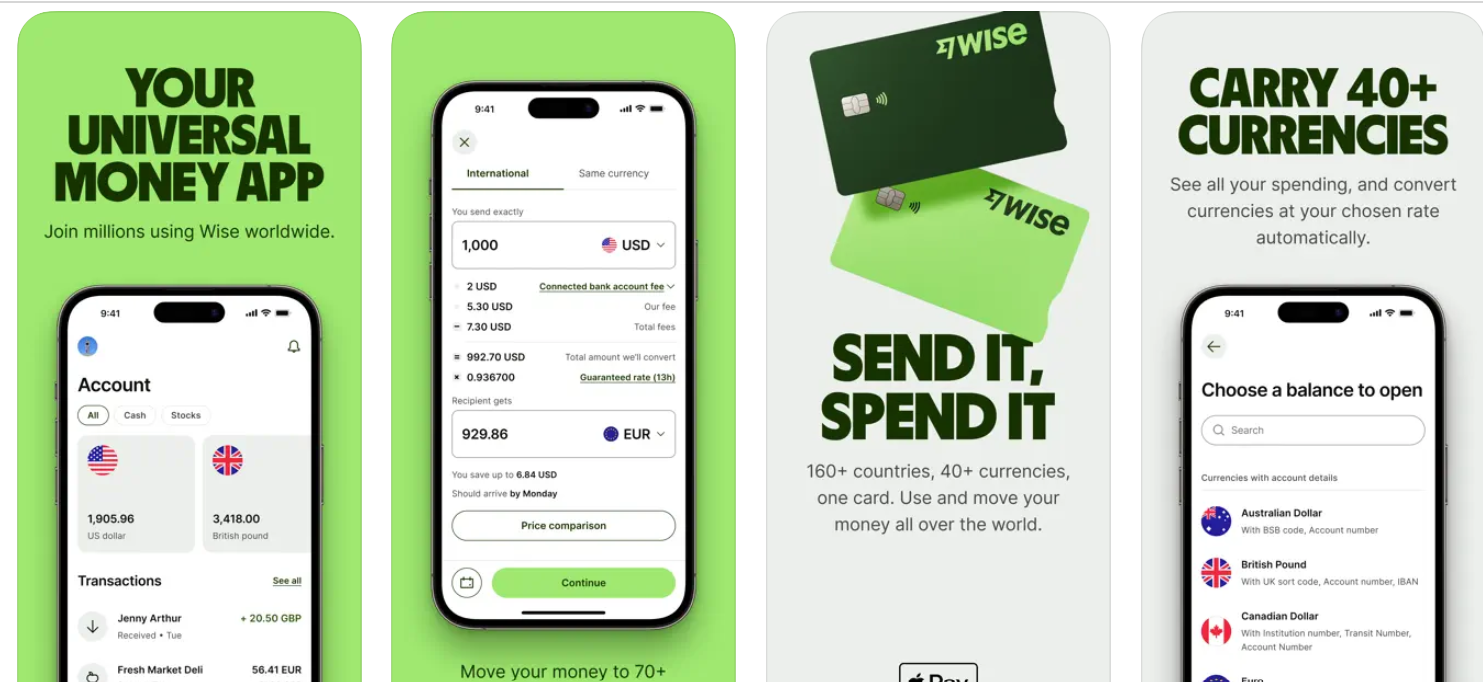

1. Wise (Formerly TransferWise):

Wise uses a peer-to-peer system to offer lower fees compared to traditional banks in Nigeria. It shows the exact amount your recipient will receive in Nigerian Naira, and transactions are typically completed within one to two business days. With a user-friendly interface and strong security measures, Wise is a reliable choice for many.

WISE Features and Benefits

- Low fees (0.5%-1.5%)

- Fast transfers (1-2 business days)

- Transparent pricing

- User-friendly interface

- Strong security measures (256-bit SSL encryption)

- Regulated by financial authorities (FCA, FinCEN)

How To Use WISE To Send Money To Nigerian Accounts From Overseas

Follow these simple steps:

Step 1: Set Up Your Transfer

- Enter the amount you want to send.

- Choose Nigeria as the destination country.

- Select the currency (NGN – Nigerian Naira).

- Enter your recipient’s details (name, email, phone number, bank account).

Step 3: Review and Confirm:

- Review the exchange rate, fees, and transfer details.

- Confirm the transaction.

Step 4: Fund Your Transfer:

1. Pay for the transfer using your debit/credit card, bank transfer, or other payment methods.

Step 5: Track Your Transfer

- Monitor the transfer status in your Wise account.

- Receive notifications when the transfer is complete.

Download Wise on iOS | Android

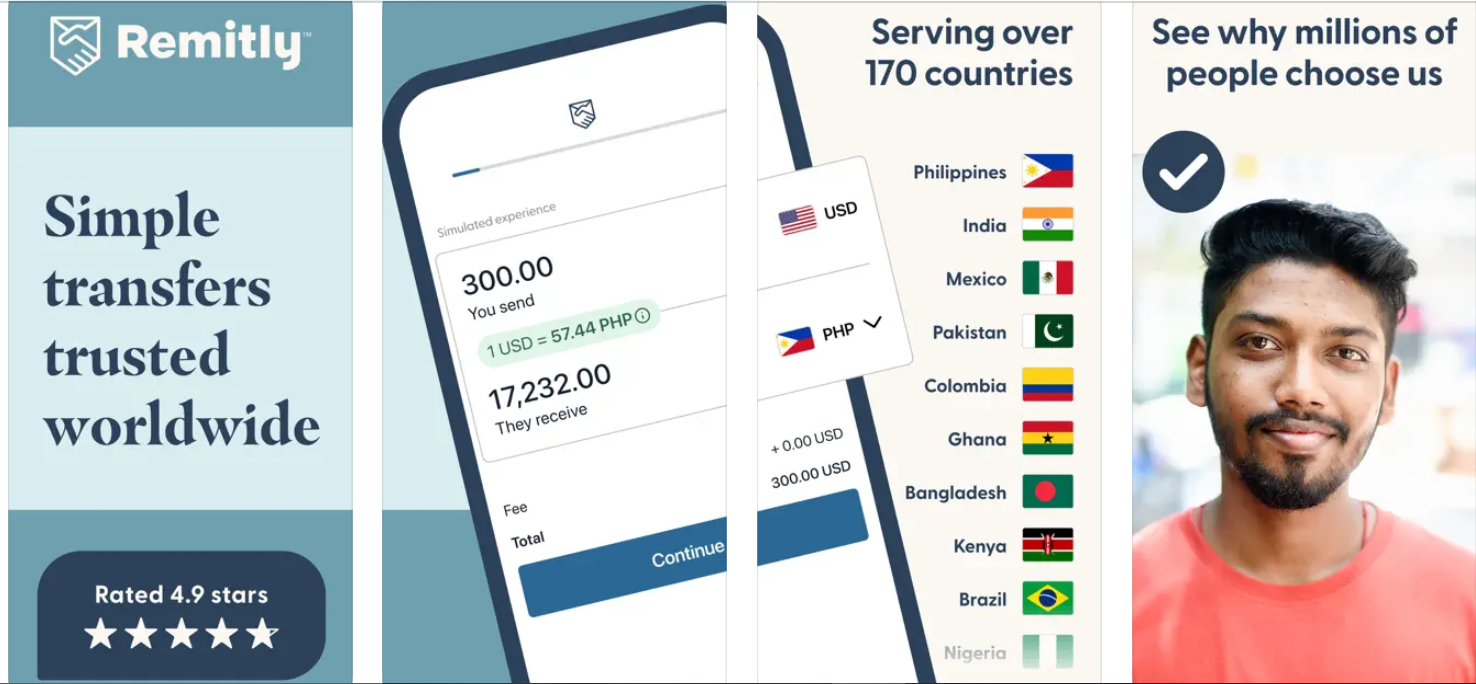

2. Remitely:

Remitly, a leading digital remittance platform caters specifically to the needs of international senders. With flexibility and convenience in mind, Remitly offers two transfer options: Express and Economy.

Also Read: Best Nigerian Business Books To Read

The Express service delivers funds within minutes, ideal for urgent transactions, while the Economy option provides a cost-effective alternative, taking up to five business days.

Please note that Remitely express transfer fees begin from $4, While economy transfers are basically $0. Minimum transfers are at $10, while maximum transfer varies by country and payment method.

Remitly Features and Benefits

- Fast transfers: Express option delivers funds within minutes

- Affordable: Economy option saves on transfer fees

- Flexible payment methods: Bank transfers, cash pickups, debit/credit cards

- User-friendly app: Track transfers, view exchange rates, and more

- Secure transactions: 256-bit SSL encryption, regulated by financial authorities

- Competitive exchange rates

- Low fees (starting at $0)

How Remitly Works:

- Sign up for a Remitly account

- Enter the transfer amount and recipient details

- Choose transfer speed (Express or Economy)

- Select payment method

- Review and confirm transfer details

- Track transfer status in the Remitly app

Download Remitly on iOS | Android

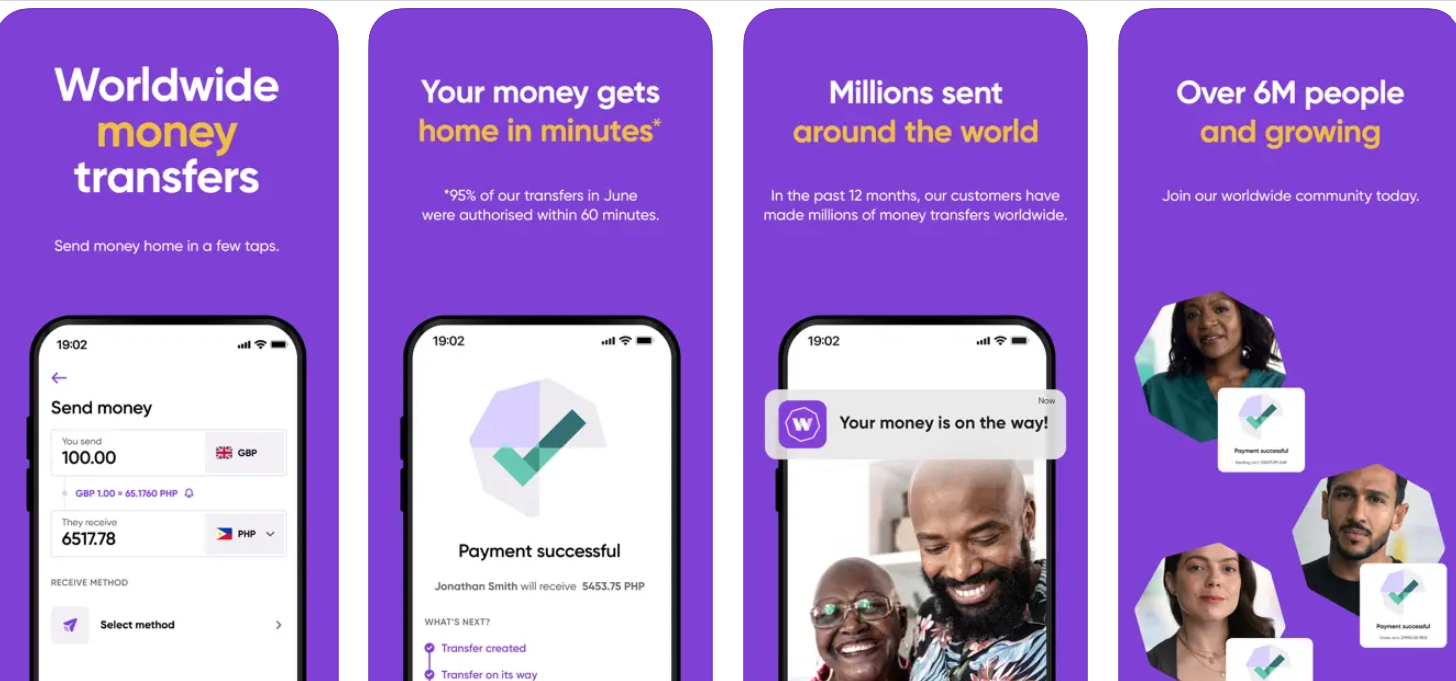

3. World Remit:

Still on the topic of apps to send money to Nigerian accounts from overseas. WorldRemit is a leading digital remittance platform that enables seamless money transfers

from your smartphone or computer. It does this with a barrage of payment options, competitive fees, and robust security features, WorldRemit has become a top choice for international senders.

WorldRemit Features and Benefits

- Easy transfers: Send money from your smartphone or computer

- Multiple payment options: – Bank deposits – Airtime top-ups – Cash pickups – Mobile wallet transfers

- Transfer fees as low as $1

- Real-time tracking: Monitor transfer status

- Robust security: – 256-bit SSL encryption – Regulated by financial authorities

- Wide reach: Send money to over 150 countries

- Daily transfer limit: $5,000

- Monthly transfer limit: $20,000

- Maximum transfer amount: Varies by country and payment method

How to Use WorldRemit to Send Money to Nigerian Accounts from Overseas

- Sign up for a WorldRemit account

- Enter the transfer amount and recipient details

- Choose payment method

- Review and confirm transfer details

Download World Remit on iOS

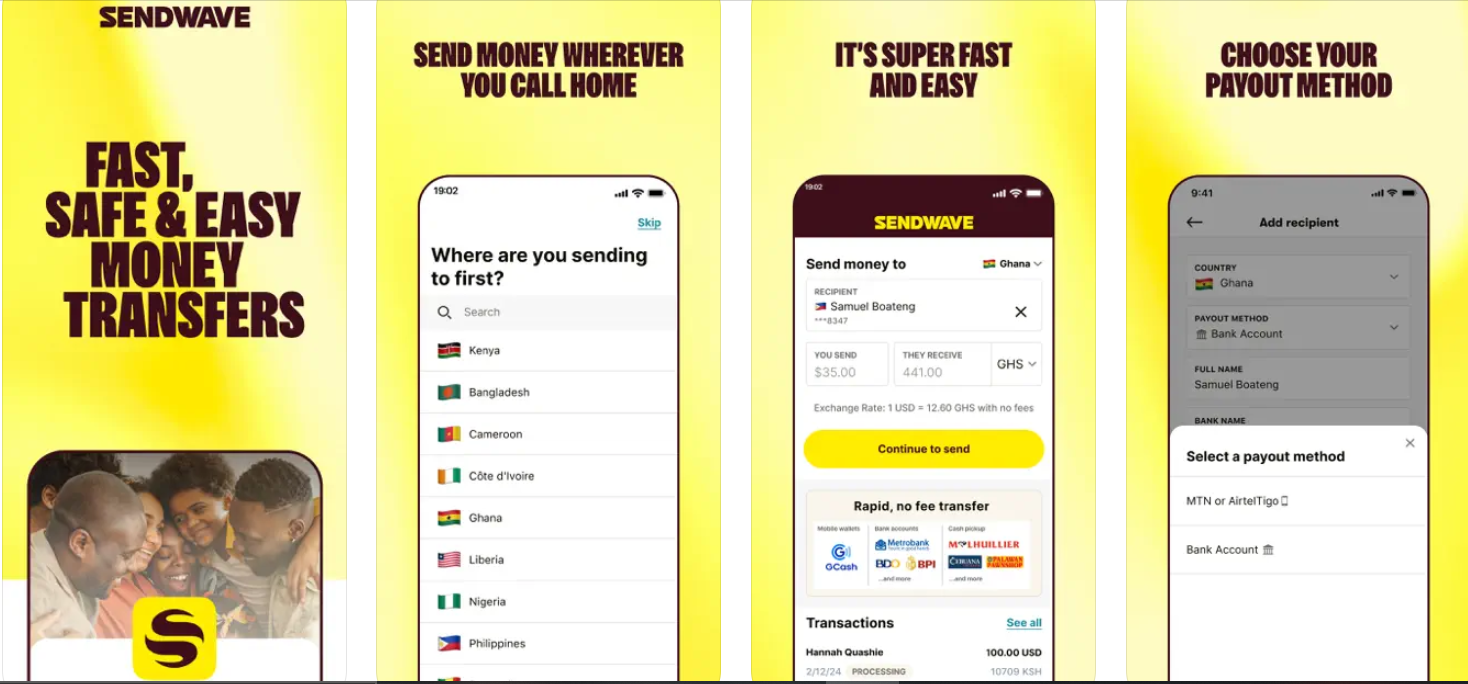

4. Send Wave:

Sendwave, a digital remittance platform, specializes in quick and cost-effective money transfers to Nigeria. With a focus on simplicity, transparency, and affordability, Sendwave enables users to send funds directly to Nigerian bank accounts or mobile wallets without exorbitant fees.

Please note that Send Waves’ transfer fees begin at 1%, its’ minimum transfer is $1, maximum transfer amount, depends on the payment method.

Sendwave Features and Benefits

- Instant transfers: Fast and convenient

- Low fees: Competitive pricing, no hidden charges

- Transparent pricing: Clear and upfront fees

- Simple design: User-friendly interface

- Direct transfers: Send funds to Nigerian bank accounts or mobile wallets

- Secure transactions: 256-bit SSL encryption, regulated by financial authorities

- Multi-language support: English, French, Spanish, and more

- Mobile app: iOS and Android compatibility

How To Use Sendwave To Transfer Money To Nigeria

1. Sign up for a Sendwave account

2. Enter the transfer amount and recipient details

3. Choose a transfer method (bank deposit or mobile wallet)

4. Review and confirm transfer details

5. Track transfer status in real-time

Download SendWave on iOS | Android

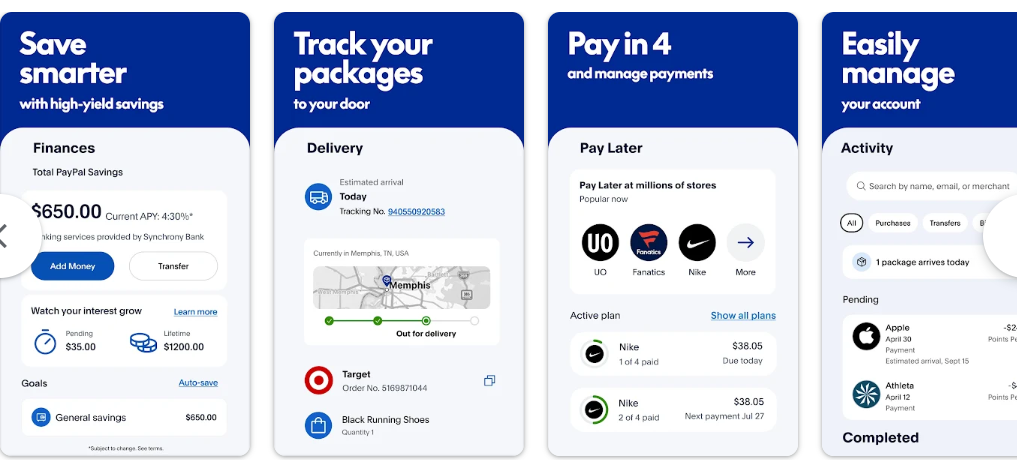

5. PAYPAL/XOOM:

Xoom, a PayPal service, offers a seamless money transfer experience for users already familiar with PayPal’s ecosystem. With Xoom, you can send funds quickly to Nigerian bank accounts or opt for cash pickup at various locations.

Note that Xoom transfer fees begin at 2%, its minimum transfer amount is $10, while the maximum transfer amount, is dependent on the payment method and the recipient country.

Xoom Features and Benefits

- Fast transfers: Same-day or next-day delivery

- Convenient payment options: Pay with PayPal balance, bank account, or credit/debit card

- Wide reach: Send money to Nigerian bank accounts or cash pickup locations

- User-friendly interface: Easy navigation and tracking

- Secure transactions: 256-bit SSL encryption, regulated by financial authorities

- Integration with PayPal: Manage finances in one place

Download Xoom on iOS | Android

Wrapping up: There you have it – a comprehensive tutorial on apps to send me to Nigeria from overseas. They are not all of the best out there, but the chances that you will go wrong with any of them are pretty slim.